Digital Operations Platform Pricing: A 2026 Guide for US Financial Services Firms sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

As we delve deeper into the intricacies of digital operations platform pricing, a world of opportunities and challenges unfolds, shaping the landscape of financial services firms in the US for years to come.

Overview of Digital Operations Platform Pricing

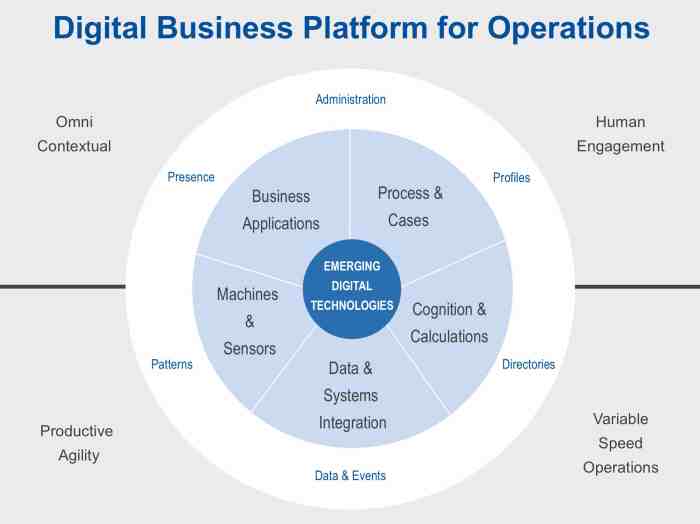

In the realm of financial services, digital operations platforms play a crucial role in streamlining operations, enhancing efficiency, and improving customer experiences. These platforms encompass a range of tools and technologies that enable firms to automate processes, manage data, and optimize workflows.

Significance of Pricing Strategies for Financial Services Firms

Pricing strategies are of paramount importance for financial services firms when it comes to digital operations platforms. The pricing model adopted can impact the firm's revenue, profitability, and competitive positioning in the market. A well-thought-out pricing strategy can help firms attract and retain customers while maximizing the value they derive from the platform.

Key Factors Influencing Pricing Decisions

Several key factors influence pricing decisions for digital operations platforms in the context of financial services firms:

- The cost of developing and maintaining the platform: The investment required to build and sustain a robust digital operations platform is a critical factor in determining pricing. Firms need to factor in development costs, ongoing maintenance expenses, and technology upgrades.

- Competitive landscape: Understanding the pricing strategies of competitors and market dynamics is essential for setting competitive prices that offer value to customers while ensuring profitability for the firm.

- Customer segments and value proposition: Tailoring pricing plans to different customer segments based on their unique needs and the value they derive from the platform is crucial. Providing a clear value proposition can justify the pricing to customers.

- Regulatory environment: Compliance requirements and regulatory constraints can influence pricing decisions, as firms must ensure that their pricing models adhere to legal and regulatory standards.

- Profit margins and revenue goals: Balancing profit margins with revenue goals is essential for financial services firms. Pricing decisions need to align with the firm's financial objectives and growth targets.

Current Pricing Trends in the US Financial Services Sector

In the ever-evolving landscape of the US financial services sector, pricing strategies play a crucial role in attracting and retaining customers. Let's delve into the current pricing trends shaping the industry.

Existing Pricing Models

- Subscription-Based Pricing: Many financial services firms offer subscription-based pricing models where customers pay a recurring fee for access to services and features.

- Usage-Based Pricing: Some firms charge customers based on their usage of the platform or services, allowing for flexibility depending on the level of utilization.

- Value-Based Pricing: This model focuses on the perceived value of the service to the customer, with pricing structured accordingly to capture the value delivered.

Competitive Landscape and Pricing Strategies

Financial services firms often face intense competition in the market, leading to the adoption of various pricing strategies to differentiate themselves. Some common approaches include:

- Competitive Pricing: Firms may set their prices lower than competitors to attract price-sensitive customers or gain market share.

- Price Skimming: Some firms may initially set higher prices to capture the value from early adopters before gradually lowering prices to reach a broader market.

- Value-Based Pricing: Firms may align their pricing with the value delivered to customers, focusing on quality and unique features to justify higher prices.

Comparison of Pricing Approaches

When comparing pricing approaches across different financial services firms, it's essential to consider factors such as target market, value proposition, and competitive positioning. While some firms prioritize affordability and accessibility through subscription models, others emphasize premium features and customization with value-based pricing.

Understanding the nuances of each approach can help firms make informed decisions to stay competitive in the dynamic market.

Factors Influencing Digital Operations Platform Pricing

When it comes to digital operations platform pricing, several key factors come into play, influencing how these solutions are priced and structured in the US financial services sector. Let's delve into the technological advancements, regulatory considerations, and customer demands that shape pricing strategies.

Technological Advancements Impacting Pricing Structures

Technological advancements play a crucial role in determining the pricing structures of digital operations platforms. As new features, functionalities, and integrations are developed, vendors may adjust their pricing models to reflect the added value these advancements bring to financial services firms.

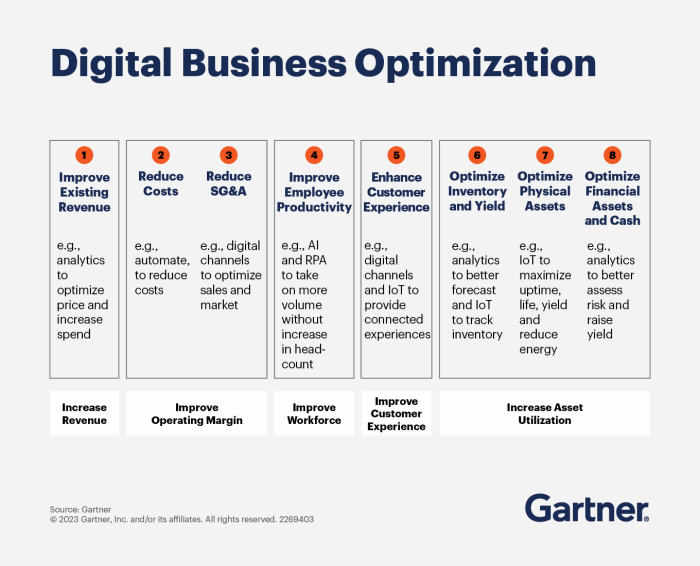

For example, the introduction of AI and machine learning capabilities can lead to higher pricing tiers, catering to firms looking for more advanced automation and analytics tools

Regulatory Considerations Affecting Pricing in Financial Services

Regulatory requirements are another significant factor influencing digital operations platform pricing in the financial services sector. Compliance costs, data security measures, and regulatory reporting capabilities all impact how vendors price their solutions. Firms operating in highly regulated environments may see higher pricing to cover the costs associated with maintaining compliance and ensuring data protection.

How Customer Demands Shape Pricing Strategies

Customer demands play a critical role in shaping pricing strategies for digital operations platforms. Vendors need to align their pricing with the needs and expectations of their target market to remain competitive. For instance, if customers demand more customization options, vendors may offer tiered pricing plans with varying levels of configurability to cater to different preferences and budgets.

Pricing Strategies for Digital Operations Platforms

When it comes to pricing strategies for digital operations platforms in the financial services sector, firms often employ various approaches to attract and retain customers while ensuring profitability. It is crucial for these firms to align their pricing strategies with the value they provide to their clients.

Common Pricing Strategies Employed by Financial Services Firms

- Subscription-Based Pricing: Many financial services firms offer subscription-based pricing models where clients pay a fixed fee on a regular basis to access the digital operations platform.

- Usage-Based Pricing: Some firms opt for usage-based pricing, where clients are charged based on the level of activity or transactions processed through the platform.

- Value-Based Pricing: This strategy involves pricing the platform based on the value it delivers to the client, taking into account factors such as efficiency gains, cost savings, and increased productivity.

Examples of Successful Pricing Strategies in the Industry

- Challenger banks like Chime and Revolut have gained popularity by offering free basic services on their digital platforms and monetizing through add-on services and premium features.

- Fintech companies like Stripe have adopted usage-based pricing, charging clients a percentage of each transaction processed through their platform, aligning pricing with the client's business growth.

Importance of Aligning Pricing with Value Propositions

Aligning pricing with value propositions is essential for financial services firms as it helps in communicating the benefits of the digital operations platform to clients effectively. When clients see the value they receive compared to the price they pay, it enhances customer satisfaction and loyalty, ultimately leading to long-term relationships and increased profitability for the firm.

Forecasting Pricing Scenarios for 2026

Predicting the pricing scenarios for digital operations platforms in 2026 involves considering various factors that could shape the market dynamics and influence pricing strategies. Let's delve into some key areas to forecast potential changes in pricing models, examine the impact of market dynamics, and discuss how evolving technologies may play a role in shaping pricing in the near future.

Potential Changes in Pricing Models

- Subscription-Based Pricing: With the increasing adoption of digital operations platforms, we may see a shift towards subscription-based pricing models where firms pay a recurring fee for access to the platform.

- Usage-Based Pricing: Some providers may explore usage-based pricing models, where firms are charged based on the level of utilization of the platform's features and services.

- Bundled Pricing: To cater to the diverse needs of financial services firms, providers may offer bundled pricing packages that combine various services at a fixed price.

Impact of Market Dynamics on Future Pricing Strategies

Market competition, regulatory changes, and customer demands are likely to influence pricing strategies in 2026. Providers may need to adapt their pricing models to stay competitive and meet the evolving needs of the market.

Influence of Evolving Technologies on Pricing

- Advanced AI and Automation: As technologies like artificial intelligence and automation continue to advance, providers may incorporate these capabilities into their platforms, potentially affecting pricing based on the added value.

- Data Analytics and Insights: Platforms offering robust data analytics and actionable insights may command premium pricing as firms seek to leverage data-driven decision-making in their operations.

- Cybersecurity Enhancements: With the growing importance of cybersecurity, platforms with enhanced security features may justify higher pricing to ensure the protection of sensitive financial data.

Closure

In conclusion, Digital Operations Platform Pricing: A 2026 Guide for US Financial Services Firms serves as a beacon of insight into the evolving realm of pricing strategies, paving the way for innovation and adaptation in a dynamic market environment.

FAQ Guide

What are some common pricing strategies in the financial services industry?

Common pricing strategies include value-based pricing, cost-plus pricing, competitive pricing, and penetration pricing.

How do technological advancements impact pricing structures for digital operations platforms?

Technological advancements can lead to more efficient operations, which may translate to cost savings that can be reflected in pricing strategies.

What role do regulatory considerations play in determining pricing for financial services firms?

Regulatory considerations can influence pricing by imposing restrictions or requirements that affect how services are priced within the industry.

![13 Great ScreenCloud Alternatives [Updated 2025 Guide] - Juuno](https://digital.kandisnews.com/wp-content/uploads/2025/12/920f59c6-5886-4772-8725-e393b73e9292-120x86.png)